Understanding STP Brokers

When it comes to trading in the financial markets, there are different types of brokers that traders can choose from. One such type is the Straight Through Processing (STP) broker. In this blog post, we will explore what exactly an STP broker is, how it works, and the advantages it offers to traders.

What is an STP Broker?

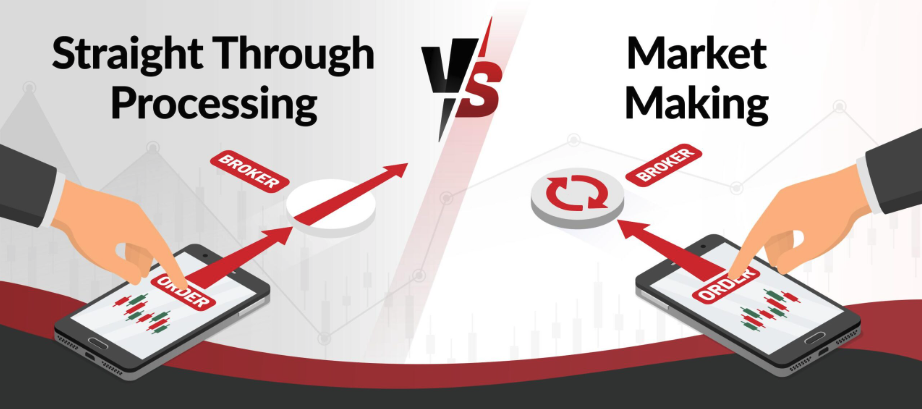

An STP broker, also known as a Straight Through Processing broker, is a type of forex broker that operates by routing client orders directly to liquidity providers without any intervention or dealing desk. This means that when a trader places an order through an STP broker, the order is sent directly to the market, ensuring fast execution and transparency.

Unlike other types of brokers, such as market makers or dealing desk brokers, STP brokers do not take the opposite side of their clients’ trades. Instead, they act as intermediaries, connecting traders to liquidity providers such as banks, financial institutions, or other brokers. This allows traders to access the interbank market and trade with competitive spreads and prices.

How Does an STP Broker Work?

The operation of an STP broker can be understood through the following steps:

- Client Places an Order: The trader places an order to buy or sell a financial instrument through the STP broker’s trading platform.

- Order Routing: The STP broker receives the client’s order and routes it directly to liquidity providers in the market.

- Liquidity Providers: The order is received by various liquidity providers, such as banks or other brokers, who compete to offer the best possible price and execution.

- Execution: The liquidity provider with the best price and execution fills the client’s order, which is then confirmed and reflected in the trader’s account.

This process ensures that trades are executed quickly and at the best available market prices, as the order is sent directly to the market without any delays or re-quotes. It also eliminates any potential conflict of interest between the broker and the trader, as the broker does not profit from the trader’s losses.

Advantages of Trading with an STP Broker

Trading with an STP broker offers several advantages for traders:

1. Transparency

STP brokers provide transparent trading conditions, as they do not manipulate prices or interfere with the execution of client orders. Traders can see the real-time market prices and execute trades at the best available prices without any hidden fees or markups.

2. Fast Execution

Since STP brokers route client orders directly to liquidity providers, trades are executed quickly and efficiently. There is no delay or re-quotes, ensuring that traders can take advantage of market opportunities without any slippage.

3. Access to Interbank Market

By trading with an STP broker, traders gain access to the interbank market, where they can trade with competitive spreads and prices. This allows for better liquidity and tighter spreads, resulting in lower trading costs for the trader.

4. No Conflict of Interest

STP brokers do not take the opposite side of their clients’ trades, which means there is no conflict of interest. The broker’s profit is derived from the spread or commission charged to the trader, rather than from the trader’s losses. This ensures that the broker is focused on providing the best possible trading conditions for their clients.

5. Scalping and Hedging Allowed

STP brokers typically allow trading strategies such as scalping and hedging. Scalping involves making multiple trades within a short period to take advantage of small price movements, while hedging involves opening opposite positions to reduce risk. The flexibility to use these strategies can be beneficial for certain trading styles.

Conclusion

STP brokers offer a transparent and efficient way for traders to access the financial markets. By routing client orders directly to liquidity providers, STP brokers ensure fast execution, competitive prices, and a transparent trading environment. Traders can benefit from the advantages of trading with an STP broker, such as transparency, fast execution, access to the interbank market, no conflict of interest, and the ability to use various trading strategies.

When choosing a broker, it is important for traders to consider their individual trading needs and preferences. STP brokers can be a suitable choice for those who value transparency, fast execution, and access to competitive market conditions.

Leave a Review