Understanding Brokers: A Comprehensive Guide

When it comes to investing in the financial markets, brokers play a crucial role in facilitating transactions and providing valuable guidance to investors. Whether you are a novice investor or an experienced trader, it is essential to have a clear understanding of what brokers are and how they can assist you in achieving your financial goals.

What is a Broker?

A broker is an individual or a firm that acts as an intermediary between buyers and sellers in various financial markets. They facilitate the buying and selling of assets such as stocks, bonds, commodities, and currencies on behalf of their clients. Brokers can be categorized into different types, including stockbrokers, forex brokers, commodity brokers, and more, depending on the specific market they operate in.

The Role of a Broker

Brokers provide a range of services to their clients, which can vary depending on the type of broker and the needs of the investor. Some of the key roles and responsibilities of a broker include:

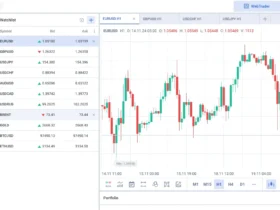

- Execution of Trades: Brokers execute trades on behalf of their clients, ensuring that the buying and selling of assets are carried out efficiently and at the best possible prices.

- Market Research and Analysis: Brokers provide valuable insights and analysis on market trends, helping investors make informed decisions about their investments.

- Portfolio Management: Many brokers offer portfolio management services, where they help clients create and manage a diversified investment portfolio based on their financial goals and risk tolerance.

- Financial Advice: Brokers provide personalized financial advice to their clients, taking into consideration their investment objectives, time horizon, and risk appetite.

- Regulatory Compliance: Brokers are responsible for ensuring that all transactions and activities comply with the relevant regulatory requirements and guidelines.

Choosing the Right Broker

With numerous brokers available in the market, selecting the right one can be a daunting task. Here are some factors to consider when choosing a broker:

- Trading Platform: Evaluate the broker’s trading platform to ensure it is user-friendly, reliable, and offers the necessary tools and features for your trading needs.

- Costs and Fees: Consider the brokerage fees, commissions, and other costs associated with trading. Compare the fees of different brokers to find the most competitive pricing.

- Customer Support: Look for brokers that offer responsive and reliable customer support, as this can be crucial when you encounter any issues or have questions regarding your investments.

- Research and Education: Consider the educational resources and research materials provided by the broker. This can be especially beneficial for novice investors who are looking to enhance their knowledge and skills.

Conclusion

Brokers play a vital role in the world of finance, providing individuals and institutions with the necessary tools and expertise to navigate the complex financial markets. Understanding the role of a broker, their services, and how to choose the right one is essential for any investor looking to make informed investment decisions and achieve their financial goals.

Leave a Review