Understanding ECN Brokerage

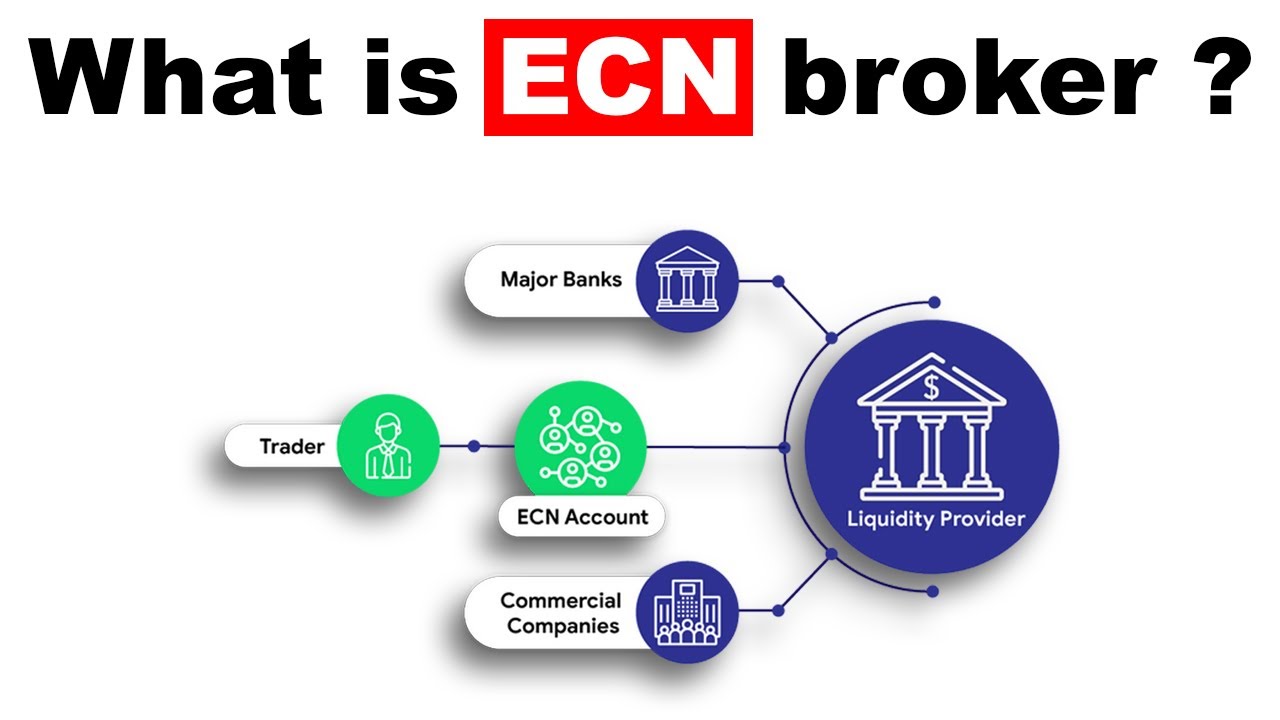

An ECN (Electronic Communication Network) brokerage is a type of brokerage that connects traders directly to the interbank market, where financial institutions and large corporations trade currencies, commodities, and other financial instruments. Unlike traditional brokers who act as intermediaries and execute trades on behalf of their clients, ECN brokers provide a direct link between traders and the market, allowing for faster and more transparent transactions.

How Does an ECN Brokerage Work?

ECN brokerages use sophisticated technology to match buy and sell orders from different market participants, including banks, hedge funds, and individual traders. These orders are then executed at the best available prices, ensuring that traders get the most favorable rates and minimal slippage.

The Advantages of Using an ECN Brokerage

There are several advantages to using an ECN brokerage:

- Tight Spreads: ECN brokers typically offer tighter spreads compared to traditional brokers, as they aggregate prices from multiple liquidity providers.

- Transparent Pricing: With an ECN brokerage, traders have access to real-time market prices, allowing them to make informed trading decisions.

- No Conflict of Interest: ECN brokers do not trade against their clients, eliminating any potential conflict of interest.

- Fast Execution: Trades are executed quickly and efficiently, reducing the chances of slippage and ensuring that traders can take advantage of market opportunities.

Overall, an ECN brokerage provides traders with a direct and transparent way to access the interbank market, offering competitive pricing and efficient execution. It is particularly suitable for active traders and those who value transparency and fairness in their trading activities.

Leave a Review